Central Bankers: From Party Poopers to Bartenders ....

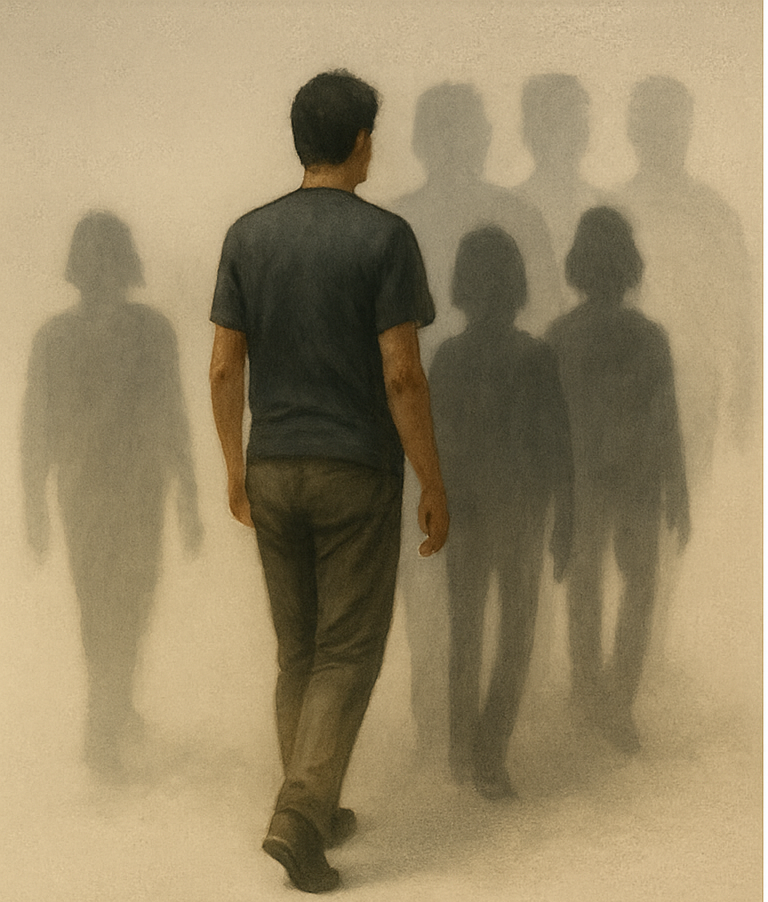

For decades, central bankers were the sober guardians of restraint — the ones who took away the punchbowl when the party got going. Today they are the bartenders, flooding the room with cheap money and calling it stability. This essay traces how that shift happened, why it flatters the present at the expense of the future, and what it means for a generation asked to inherit debts it never incurred.

The Punchbowl

Not many people manage to define their profession's purpose so clearly and memorably. William McChesney Martin, Chairman of the U.S. Federal Reserve from 1951 to 1970, did when he said that the Fed’s job was “to take away the punch bowl just when the party is getting good.” Even as a teenager, I understood that politicians and markets can get carried away, show some of that "irrational exhuberance, during property, stock market, or internet bubbles, and that central bankers were supposed to be the adults in the room — there to step in, hopefully at the right time.

How things have changed. Another crisis, another exception. The idea that an economy should manage its debt and the amount of money is circulation is still a golden rule, except when it is not. Appartently a complex name "quantitative-easing" is pretty much all you need repackage unlimited debt. Instead of taking away the punchbowl, Central Bankers now routinely bring a firehose of new money to the party. Lets pause and remember

- The global banking crisis of 2008 t0 2012 where the Feds balance sheet expanded from under $1 trillion to over $4 trillion, with the EU, UK, and Japan following with their own QE programmes.

- The Eurozone debt expansion with the ECBs chair promising to do "whatever it takes" to preserve the Euro. The result? ECB balance sheet grew to nearly €5 trillion by 2018

- The 2020–2022: COVID-19 Pandemic Stimulus where U.S. debt jumped from $23 trillion (end-2019) to $30 trillion (by early 2022) and the ECB launched PEPP (Pandemic Emergency Purchase Programme) in 2020, adding €1.85 trillion to its balance sheet.

From Friedman and Hayek’s insistence on monetary restraint to Lucas, Kydland, and Prescott’s warnings inconsistency of policy, there is a lineage of Nobel laureates who would be appalled by the sight of central banks monetising debt when it is politically convenient. Not that Economists are bothered about consistency, following the 2013 Nobel to Eugene Fama and Robert Shiller in the same year — one for proving that markets are efficient, and the other for proving that they aren’t. However, I suggest that even non economists are uneasy with a shift from controlled credit to unlimited credit.

The Shift – From Restraint to Rationalisation

What was once exceptional is now almost familiar. And there lies the problem. After decades of warnings about restraint in personal, commercial, and national debt, it now turns out that governments can simply print money to fund rogue bankers, distressed regional economies, and even, as during COVID, to pay people to stay at home.

This is not theoretical. The debt is real. The terms remain the same: an exchange of money now in return for repayment with interest at a later date. Printing money and extending debt maturities are merely accounting disguises for the same act — shifting the repayment burden to the future.

The Generational Arbitrage

It is the term of the expanding national debt that is most concerning. Extending repayment horizons further and further into the future is effectively passing the debt to the young, at a time when their prospects for property ownership and employment are weaker than they have been for decades. It amounts to an intergenerational Ponzi scheme: today’s comfort paid for by tomorrow’s diluted currency.

This approach is sustained by politically dominant older cohorts securing what younger ones cannot: subsidised healthcare, pensions indexed to inflation, and asset values inflated by artificially low interest rates. Meanwhile, younger taxpayers face higher entry costs for housing, lower real wages, and longer working lives.

While younger people must indeed become politically active to defend their interests, there remains a moral and legal argument that older generations are engaging in behaviour that would be unacceptable between individuals. Debts are not inheritable, and never have been. Insolvency exists precisely to bring excessive and unrepayable debt to an end, crystallising the consequences in the present and allowing others to move forward unencumbered. Exploding national debt undermines this principle completely. At a personal level, many people are living at a standard of comfort beyond theirs and societies ability to pay for it within a reasonable horizon.

The Collapse of Credibility

In times when our best intentions fade, we rely on institutions. They are our intergenerational glue — the adults in the room. Yet central bankers appear to have surrendered that role.

Where they were meant to provide the brake, they have become the enablers. The culture of “this time is different” has replaced the principle of prudence. Repetition erodes all political will to be disciplined. How long before this attitude reaches personal debt?

Once credibility was based on the willingness to say no; now it rests on the ability to rationalise. Nobel Prize–winning economists, though not always consistent, built their theories on assumptions of scarcity and intertemporal discipline — both now abandoned. What began as a wry observation about an uncelebrated but essential institution’s purpose now reads as wisdom discarded.

What Comes Next

The Economist recently hosted a discussion on expanding national debt driven by rising defence, pensions, and healthcare costs. They examined the possible exits: immigration, taxation, and inflation.

On immigration, they correctly noted that immigrants also age, merely postponing the problem. Tax increases were dismissed almost casually — “no one will accept them” was the consensus. Inflation was left as the politically convenient option, with its addictive side effect of reducing the real value of debt. If I owe ten dollars today and repay it a year from now with ten per cent inflation, I have effectively paid less.

It is sobering to realise that tax rises, though the only honest means of repayment, are politically impossible. Inflation, by contrast, allows governments to pay their bills with cheaper money. It is moral evasion by arithmetic.

The Firehose and the Music Too

Ironically, control of inflation is also an historic role of Central Bankers. Where does that leave them? They are presiding over unprecendented expansion of debt and will likely now quietly stop talking about inflation targets. Is it their fault? Institutionally, yes, but the loss of restraint is not a technical failure but a moral one. As long as the over 50s, myself included, see it as their entitlement to unfunded pensions, unlimited health care, and spending less and less of their lives in productive roles, the recovery will begin only begin when we embrace honesty over comfort.

The punchbowl was never taken away. It was enlarged, refilled, and passed around with a knowing smile. The guardians of restraint became the hosts of indulgence, insisting that the music could go on indefinitely. Sooner or later, the lights will come on. Inflation, taxation, or default — one of them will end the party. When it does, the test will be whether we have learned anything at all.