Data is Oil … from Seven Sisters to Seven Bros

Before the late 19th century, oil was a largely untapped resource. Its transformation into the lifeblood of the global economy was driven by infrastructure, innovation, and monopoly. The oil majors controlled not just the resource but its entire supply chain—refining, transportation, and distribution. Even when Standard Oil's initial monopoly was broken up in 1911, the fragments—Exxon, Chevron, and others—went on to dominate the international oil industry, alongside British, Dutch, and other global players, giving rise to the "Seven Sisters" that controlled oil markets well into the 20th century.

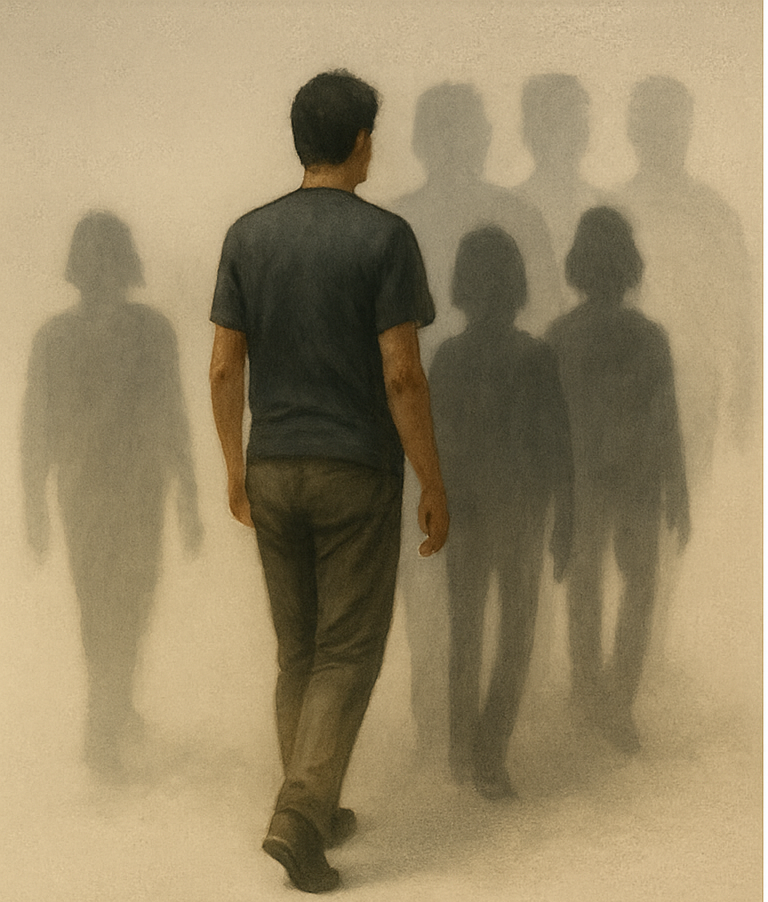

Today, data is undergoing a similar evolution. Once a by-product of human activity, it has been refined into a high-value resource by a new set of Majors: Google, Meta, Amazon, Apple, Microsoft, TenCent and Alibaba. Like the oil giants before them, these "Seven Bros" don’t just process data; they control the platforms, algorithms, and infrastructure that determine how data flows and who profits from it. Together they dominate the digital economy.

Data Is Not Oil (But It’s Close Enough)

Unlike oil, data is infinite and can be reused endlessly. However, its value is unlocked in much the same way: through refinement. Big Tech companies aggregate vast streams of data, analyze patterns, and apply insights to create products, services, and advertising algorithms. What makes this even more galling is that we, as individuals, are the ones creating this data—only to see it processed, refined, and sold back to us at a profit. For example:

- Google refines search queries into targeted ads that account for the majority of its revenue.

- Amazon leverages purchase histories to optimize logistics and drive consumer behavior.

- Meta (Facebook) turns user interactions into personalized advertising, reshaping how businesses reach customers.

This refinement creates immense value but also consolidates control. Just as the oil majors controlled pipelines, Big Tech owns the digital infrastructure—platforms, cloud services, and algorithms—that underpin the data economy. This dominance ensures that the profits flow upward, while users, governments, and societies do not see the fair value their data, the raw mateial of the whole tech economy.

Global Influence

The oil Majors weren’t just economic powers—remember how they shaped geopolitics. From regime changes in Iran and Venezuela to securing access to oil-rich regions, underplaying environimental impact and the effects of lead additives, their influence was felt worldwide. Big Tech is following a similar path, wielding influence through the control of information. Algorithms shape public discourse, elections, create a new childhood and teen culture, and even access to education and healthcare. The decisions of a few corporations reverberate across economies and political systems.

Efforts to regulate these companies have been slow and piecemeal, often outpaced by the speed of technological change. While there are growing calls to break up Big Tech monopolies, history teaches us that even when monopolies are dismantled, as in the case of Standard Oil in 1911, the underlying concentration of wealth and power can persist. John D. Rockefeller’s fortune only grew after Standard Oil was split into smaller companies. We need to be thoughtful about what we might get from freeing up the market from the dominance of the seven "brothers".

Reclaiming Value Without Losing Innovation

Big Tech’s dominance isn’t without benefits. These companies have deployed immense funding to drive innovation. They have connected the world, and created tools that have transformed industries. But as with oil, the concentration of wealth and power raises critical questions. How can we ensure that more of the value created from data also flows back to individuals, governments, and societies?

One solution is greater transparency and regulation, including taxation of digital services and requirements for fair data-sharing practices. Another is fostering competition, encouraging the growth of smaller, more diverse companies spread across all cultures in the tech ecosystem. Above all, societies need to recognize that data is a resource we collectively create and should collectively benefit from.

A Better Future for Data

The lessons from oil are clear. Monopolistic control over critical resources leads to imbalances that are difficult to undo. But the story of data is still being written. We have the opportunity to ensure that this new resource benefits everyone—not just those who control its pipelines.

To achieve this, we must focus on two priorities: capturing more value from data for individuals, societies, and governments, and controlling oligopoly power to prevent Big Tech from following the same path as the oil majors. The goal isn’t to stifle innovation but to ensure that the digital economy works for the many, not just the few.