Explaining AI in Development Finance: A Clear, Actionable Guide for Management Teams

An Apology and a Fresh Start

Last week, I prematurely jumped into the details of AI Readiness Audits. In my enthusiasm to provide practical advice, I began with a step further along the journey. This post corrects course by starting with the essentials—what AI actually means for development finance.. Consider this blog installment the reset—a guide to understanding AI’s urgent relevance to the sector.

The Industrial Revolution of Knowledge

AI represents a transformational shift in how knowledge is created, accessed, and applied. If the Industrial Revolution moved us from manual labor to much larger scale mechanisation , AI does the same for intellectual and analytical tasks. Just as machines replaced repetitive physical work with efficient processes that were scalable way, way beyond previous limitations, AI offers the same leap for technical knowledge, analysis, and communication.

For development finance organizations—whether multilateral development institutions (MDIs), grant funders, loan applicants, or governments—this metaphor is more than an abstraction. It signals a practical and immediate shift in how work is done, risks and challenges are addressed, and opportunities are seized.

Why AI Resonates in Development Finance

Development finance turns large devleopment budgets and through a multitude of complex and interdependent systems, turns them into positive outcomes for individuals, familiies, companies and nations. AI fits into this landscape by offering transformative benefits across multiple domains:

1. Technical Knowledge at Scale

AI enables anyone—whether a borrower or a funding officer—to access and apply knowledge with unprecedented ease. Complex technical calculations, data analysis, and modeling can now be done by asking the right questions of an AI tool. This democratization of expertise means that:

- Borrowers can create higher-quality proposals, reducing the need for external consultants.

- Analysts can run scenarios in minutes that previously took days, creating more insights and more options.

- Governments can plan more efficiently by simulating policy outcomes or infrastructure projects.

2. Enhanced Analytical Power

AI doesn’t just do large datasets faster, it thrives on levels of complexity that were previously accessible to the very few. For MDIs and other financial institutions, this means:

- Risk Assessment: AI models can analyze patterns in borrower histories, market trends, and macroeconomic data to identify risks faster and more accurately.

- Fraud Detection: AI tools can spot anomalies that human teams might overlook, reducing exposure to high-quality fraud targeting finance systems.

- Impact Evaluation: AI can automate and enhance impact analysis by integrating diverse datasets, offering clearer insights into what works and why.

3. Communication and Presentation

AI-driven tools make it easier than ever to create professional reports, presentations, and communication materials:

- For grant applicants, AI can refine narratives to meet funder expectations.

- For funders, it can generate automated summaries, dashboards, and updates tailored to stakeholders, resulting in quicker turn arounds and faster disburesments.

- For governments, it can translate complex data into persuasive materials for negotiations or public engagement.

4. Fraud Risks

The same capabilities that empower teams can also be exploited for fraud:

- Sophisticated AI-generated documents or data manipulations can make fraudulent applications appear credible.

- Institutions must be vigilant, ensuring robust governance and fraud detection systems.

Where AI's Impact Is Limited

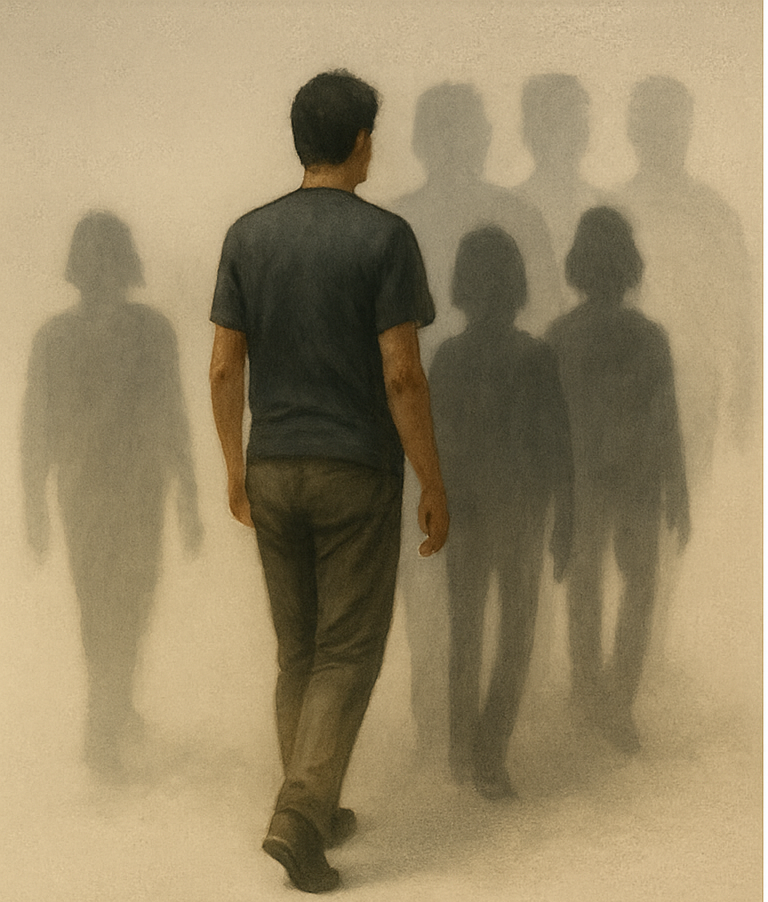

While AI transforms intellectual and analytical roles, some areas remain more resistant to automation. These are typically roles that demand high levels of emotional intelligence, creativity, or human interaction:

- Direct Customer Interaction: Relationship-building with borrowers, partners, or governments often requires empathy and nuanced communication.

- Human Resources: Navigating complex interpersonal dynamics and fostering organizational culture remain human strengths.

- Creativity: Innovative problem-solving and visionary leadership continue to rely on human ingenuity.

Why Act Now?

The implications of AI for development finance are profound, but they are not insurmountable. By acting now, organizations can:

- Stay Informed: Understand how AI tools are already reshaping the sector.

- Evaluate Needs and Opportunities: Identify where AI can add the most value in your organization.

- Mitigate Risks: Build awareness of vulnerabilities, particularly around fraud and governance.

- Plan Strategically: Develop a roadmap for AI adoption that aligns with your goals and resources, starting with first steps tailored to your organization’s capacity.

Conclusion

AI is not just another tool; it is a fundamental shift in how knowledge is accessed and applied. For development finance, the opportunity is clear: harness AI to enhance efficiency, accuracy, and impact. Equally, the risks are evident: failing to engage with AI leaves organizations vulnerable to falling behind or being targeted by increasingly sophisticated fraud.

This is the starting point for understanding AI in development finance. With this foundation, we can now explore actionable steps like readiness audits and implementation strategies—but only after appreciating the profound shift AI represents. Let’s proceed with clarity, purpose, and the recognition that the time to act is now.