Lessons from Weather Forecasting: Rethinking economics and growth

The Challenge of Predicting Complex Systems

How similar are economics and weather forecasting? Both try to model into the future in the face of enormous, if not infinite, complexity. One speaks in probabilities and confidence intervals, revises its predictions daily, and is trusted more each year. The other speaks in prescriptions and outcomes, offers grand theories, and walks away from failure with its status intact. Weather forecasters do not promise to stop the rain. Economists, on the other hand, prescribe theory after theory to tame inflation, prevent collapse, and grow the future on command.

The Illusions of Certainty and Dogma

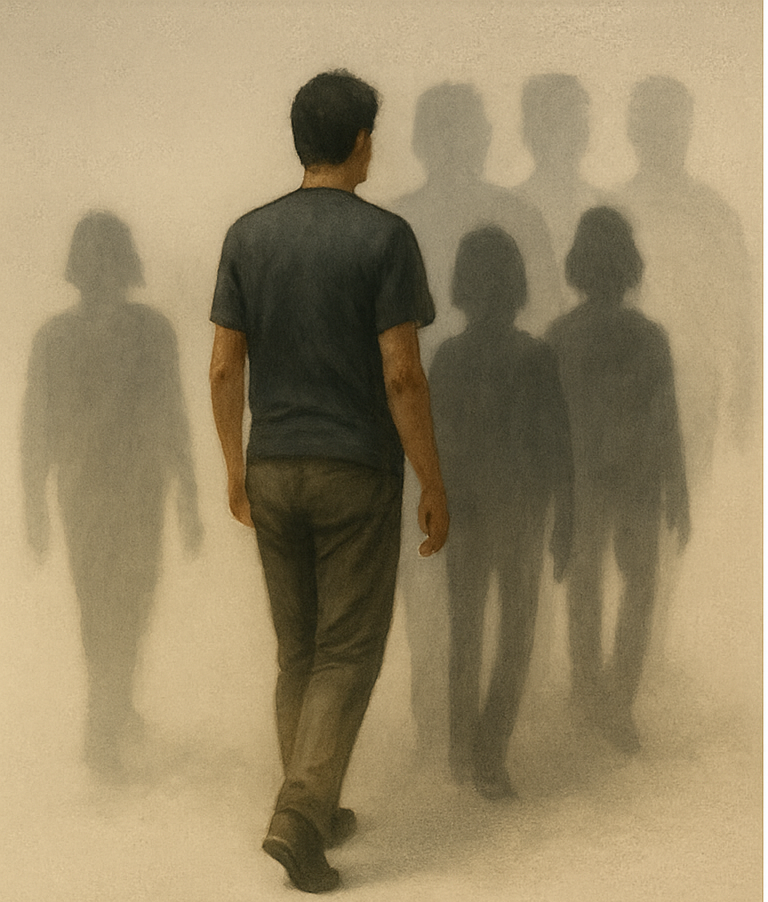

Economics has the harder task in the sense that it deals with human behaviour, political cycles, conflicting incentives, and feedback loops that don’t repeat. No one doubts the complexity. The problem is that complexity seems to be used to justify more certainty, not less. Weather forecasting has never hidden uncertainty and has still fully engaged with the public—who, I suspect, pay it more attention than the latest economic forecast. Economists appear to struggle with their inability to deliver certainty, but instead of humility, we get a series of gurus who come and then fade away, in a never-ending theatre.

Alongside the Friedmans and Keynes'—and events like the collapse of Long-Term Capital Management formulas—another enduring feature of economics is orthodoxy. The greatest of these is growth, and the sectors greatest achievement, or perhaps its greatest sleight of hand, has been to embed the belief that growth—measurable, perpetual, expansionist growth—is not just desirable but necessary. That idea has taken root not only in policy and business, but in how society understands success, urgency, even hope. It is not presented as one option among many. It is presented as the only way forward.

The Problem of Perpetual Growth

Growth is the sine qua non of mainstream economics, and not by coincidence, politics. Together they insist growth is natural, as if it were a pre-requisite of life itself, confusing it perhaps with change. Growth is not just a sign of progress, but the definition of it. This belief is so widely promoted that to question it is often seen as eccentric or dangerous. Yet the effects of pursuing growth without limit are now all around us: ecological degradation, soaring inequality, the churn of disposable work and throwaway goods. The concept of profits always growing is absurd, but apparently essential. Growth has become a justification for short-term thinking, for systems that devour energy and human attention but deliver little that lasts. It is used to defer responsibility and disguise failure. Promises are made not to fix the present, but to expand out of it.

Growth as a Substitute for Justice

In the marriage of economics and politics, growth has become a substitute for justice. All mainstream parties propose that rather than redistribute power or wealth, we should wait for the rising tide. Social tension is repackaged as temporary imbalance. Environmental damage becomes an unfortunate side effect that will be solved later, with more innovation, funded by more growth. The story never ends, and that is precisely the point. Growth never needs to be achieved, only pursued. It is not a measurement. It is a deflection. It is never enough.

Quality, Resilience and Balance

We need to turn down the volume on this mantra of economic orthodoxy. There are alternatives - of course there are. The most obvious is to stop mistaking quantity for quality. Not all expansion is improvement. An economy can grow while life becomes more precarious, more polluted, more fragmented. A better goal would be resilience—perhaps expressed in time, in public health, or in shared stability. Doughnut economics reframes growth within ecological ceilings and social foundations, aiming for balance rather than endless expansion. Maintenance economies focus on sustaining what matters—repairing infrastructure, valuing care, and prioritising continuity over churn. These ideas also allow government, and those who what to govern, to promise something other than relentless expansion.

Growth is not the Enemy – But More is Not Always Better

None of this requires collapse or retreat. There is room for growth where it helps. There is reason to slow down where it heals. The problem is not growth itself. It is the idea that more is always the answer, and that anything less is failure. We need to stop this chorus, this contrived performance that advocates only one approach and encourages false promises and outright misdirection.

The IgNobel Prize for Economics

Too harsh? Consider the Nobel Prize, a brand which historically in the sciences has rewarded ground breaking, tested advances, many years after their importance and resilience has been confirmed. In 1969 the Swedish Central Bank grafted the economics prize onto the brand and, in one masterful PR stroke, gave the field a new legitimacy. It might have remained the Sound Engineering category of the Nobels—niche, technical, mostly harmless, but unfortunately, it has not. The prize seems to celebrate advances in economic thinking long before their due. It has too often rewarded economists whose theories have failed in practice, sometimes spectacularly. Milton Friedman, architect of monetarism whose claims of effectiveness are diluted with every passing year. Merton and Scholes, whose modelspromised better risk management and then helped trigger the collapse of Long-Term Capital Management. Eugene Fama, father of the Efficient Market Hypothesis—awarded in the same year as Robert Shiller, who proved markets are not efficient....

Humility and Probability

Humility and less dogma would not diminish economics. Maybe devote more of that impress talent to alternatives to growth. Perhaps this would make the dismal science more respected, and more useful to wider society.