Big Techs Mission Creep

Your Property, Their Paywall

Capitalism’s genius lies in ownership and competition. Through these, it delivers efficiency, quality, and choice. Companies earn profit, and customers gain satisfaction.

I am not a disciple of Friedman. Profit alone does not sanctify business. While it is a clean formula, the problem is that it does not exclude exploitation of customers, employees, or the environment. If anything, I stand closer to Smith: markets embedded in moral life; Schumpeter: innovation, not rent, as capitalism’s engine; or even Drucker: the customer as the purpose of business.

Against these benchmarks, today’s tech oligopolies are moving into dangerous territory. Under the guise of youth and innovation, these companies, now consolidated into an oligopoly of seven firms, are not just greedy. Already systematically removing the power and informed consent of customers, they underprice the data they extract from every source, then sell it to suppliers, prioritising them over consumers. Now they are undermining ownership itself—the core that makes capitalism work

The irony is that even Friedman would likely call out this dismantling of ownership and its quiet enjoyment. He would do so, I suggest, not out of altruism but because without ownership there is no functioning capitalism at all.

The Warning that is Market Power

Concentration of market power is not new, and neither is the requirement to pay it close attention. We have all suffered the effects: excessively high prices, reduced choice, and declining service as the edge of competition dulls. Innovation slows because firms protect their turf. The customer still pays, but gets less value, less dynamism, less responsiveness.

This dynamic is never-ending, and the struggle against it is healthy. Society has already seen off abusive practices in child labour, egregious pollution, and predatory financial contracts—all of which were initially presented as essential to profitability. We have learned to see through tech companies defending lack of choice or smothering competition with inflated claims about “preserving innovation” or “maintaining standards.”

We should expect to remain vigilant and fight similar battles with the emerging Big Tech oligopoly of Google, Meta, Amazon, Apple, Microsoft, Tencent, and Alibaba. The challenge to fundamental ownership in this context, however, is not business as usual. It is a new front—one that goes beyond the familiar harms of market dominance—opening a deeper conflict over the core that makes capitalism work.

From Data Extraction to Customer Control

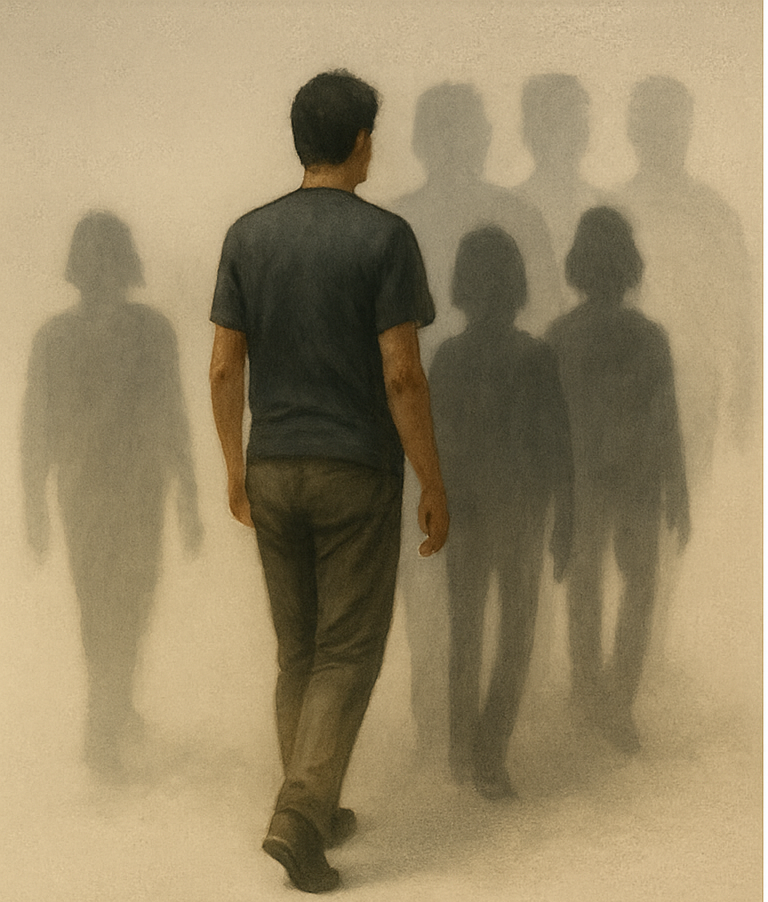

Such is the pace of change that as we wake up to how tech firms mined all data as a free input, they have already moved on. It is sobering to realise that the phenomenal profits accruing from this insight—an insight for them, a blind spot for the rest of us—are not being applied solely to further technological innovation, but to reimagine the business model itself. Their sharpest strategists are recasting the customer is not as an independent actor, but as a fully controlled resource.

Congratulations are due to the innovation of data mining and monetisation. Innovation deserves its rewards. But once the value of data became visible, firms could have recalibrated. Instead, they doubled down—retaining, expanding, and normalising the model:

- Data is underpriced to the point of invisibility.

- Platforms serve suppliers first: enquiries deliver feeds, not choices; unwanted marketing, previously despised SPAM, has gone mainstream; manipulative interfaces keep users online longer.

- The quid pro quo of service has lost any meaning when the original model has shifted from Business to Consumer, to Business To Supplier To Consumer

The outcome is not unexpected, which makes the strategy driving it deliberate. Customers are demoted, infantilised and domesticated, treated both as sources of underpriced raw material and as purchasers of promoted—but not necessarily the best—products. The customer is no longer king or queen. People have been reduced to passive cash cows, not active agents exercising informed choice.

This is not capitalism at its best, and it continues to get worse. Now ownership—the keystone of capitalism—is being diluted and captured in novel ways.

From Our Data to Their Property

When software first emerged itimediately presented new challenges to busineses used to purchasing hard assets. It was expensive, but intangible. Software companies tried to persuade banks to offer financing terms, but they resisted, becuase what in the end could they repossess or resell if the buyer did not repay? It was very hard to take the computer for an unpaid license.

This was resolved as soon as the software companies became profitable enough to finance their own software. It helped that frequent updates rapdily became a feature and clients and customer feared not to have the latest version. So far so good. The customer owned the computer. The software company licenced the software.

With the breakthough realisation that data had value a new frontier opened up, and with it new payment models. Or perhaps non payment models. The value of data mining was more apparent to the innovators than to the sources of the data, so a bargain of sorts was struck. Give us your data and we will deploy it to give you choice and get things done faster. The first two steps beyond fair exchange were taken. The true value was not revealed, and the purpose was hijacked. Choice became control, and the service turned out to be much less to the consumer, and far more to the supplier.

The mindset that continues to offer this false bargain now extends into the physical and digital assets we purchase. It is banal to observe that software is essential, and its price is a matter of its impact, and competition. That software should now be used to take control of the phone, computer or car away from the purchaser and give it to the software company is significant. It changes ownership, dilutes control and again, is not made clear in a fair negotiation.

Examples of the erosion of ownership are already widespread in the market

– Devices altered post-sale via software updates that remove features or change interfaces.

– Identity wars over login, settings, and user environment fought on an individuals device, directed remotely.

– Customers excluded from informed consent at the moment of purchase resulting in suppliers retaining unilateral control.

The reliance on the legality of terms and conditions ignores the reality of informed consent. The idea of hide and seek permissions would be childish if the consequences were not so important. What is happening here is a strategic errosion of ownership rights. The traditional rights to use as one chooses, control modification, and quiet enjoyment without interference are each ignored as property becomes conditional access, not possession.

Not This Time

Expanding the power of an oligopoly does not advance capitalism, whose purpose is to improve outcomes for society, and not just shareholders. The same approach to dilute share ownership, change rights, replace dividends with promises of a service that is not as represented would temporarily shift the attention of the in-house lawyers from intimidating or confusing consumers to protecting the fundamental rights of shareholders.

The determination to protect ownership as a keystone of capital needs to manifest itself. Whats happening now is not the classic oligopoly drift into higher prices, less choice and declining service. Using software leverge to ensure payment of its development and use is fair. Expanding its application to become a virus that weakens ownership is too much. For at the end of the day, if ownership erodes, capitalism’s bargain collapses.

This over-reach is not incidental. It reflects the settled strategy of an oligopolistic tech sector that now competes less to serve than to control. Reassurances to the contrary are not credible from a sector that promised to do no harm, to embed choice, and to expand the benefits of information. In every case, the small print might as well have read: “for ourselves.”

Capitalism's Line in the Sand

It is worth repeating that capitalism is the best system we have found for improving outcomes across society, accepting that these benefits are neither simultaneous nor equal for everyone. Over time, quality of life has risen for all. When cynical and misguided abuse is uncovered, society pushes back—through law, through norms, through consumer pressure. Capitalism adapts, and the process of true innovation advances.

Exploitation appears profitable in the short term, but it weakens capitalism itself, eroding legitimacy and shrinking markets. Tech’s assault on ownership exploits its market power and expertise. It looks profitable now, but it hollows out the very system that enabled its rise. The question is whether correction comes in time: to prevent capitalism shrinking into a system with a hollowed concept of ownership—and worse, to stop that model embedding itself permanently, with all its drawbacks, in the hands of a data oligopoly. The consequences for ownership are already visible.

Your Property, Their Paywall

Big Tech’s vision is clear in its creeping extension from service to control. It may be your property, but it is their paywall. Unless you ask, pay, or surrender more data, you cannot use what you bought in the way you expected when you paid for it.

The response from society must be equally clear. This is not a direction that improves capitalism or strengthens ownership. Rather than surrender again through quickly read, poorly understood terms and conditions, this time we insist. Ownership is meaningful, and it is the core that makes capitalism work. It is not to be traded for feed of beads and trinkets we do not want.