The One-Way Windfall: The Oil Sector’s Built-In Crisis Bonus

Every time there’s a geopolitical scare—like now—we all feel it at the pump. Petrol prices rise rapidly, and the explanation sounds familiar: tension somewhere in the world is putting pressure on supply. Yet the oil wells haven’t stopped. The pipelines are still running. The amount of oil in the system hasn’t changed. What has changed is the mood. Prices shoot up on the possibility of future disruption, not on any actual shortage.

We’re told this is just how the market works. Traders and producers move early to lock in higher prices in case the crisis escalates. On the face of it, that sounds reasonable. A mechanism designed to smooth volatility should let us secure supply before things get worse. If that’s true, though, it should work both ways. When the crisis fades and the oil keeps flowing without disruption, prices should come down again.

That is not what happens. When the threat fades or dimishes, there’s no equivalent correction. Very simply, the oil majors restrict output to avoid prices dropping too low. The result is a bankable surge immediately in profits with no downside in the future. What should be market efficiency has become a tool of extraction.

Futures markets were meant to protect society from sudden price shocks—to help manage uncertainty in the public interest. Instead, they’ve become a fast, flexible instrument for locking in profit at the first sign of trouble. Every crisis, real or imagined, is another opportunity to charge more for the same barrel.

Here’s how it works:

1. Speculation, Not Scarcity, Drives Price Surges

The market doesn’t wait for real disruption. It moves on expectation. A threat to supply becomes a tradable asset. Futures markets react to the idea of risk, not actual loss. Producers and traders earn more even though nothing has changed—no higher costs, no reduced output, no new investment. Just sentiment.

2. The Fear Premium Is a Transfer, Not a Cost

The price increase isn’t paying for new infrastructure or energy security. It’s a direct wealth transfer—from the public to the producers. This isn’t supply and demand at work. It’s fear being monetised. A global event becomes a margin opportunity.

3. Strategic Reserves and Stockpiles Don’t Smooth Volatility

There is no effective buffer. Stockpiles exist, but they aren’t used to stabilise prices only in very extreme circumstances. Politicians sit on reserves. Traders ignore them. The market moves faster than any counterbalance, and a tool that could defend the public becomes decorative.

4. There’s No Reversal When the Crisis Passes

Prices fall slowly—if at all. When the fear subsides, there’s no refund. No windfall clawback. OPEC cuts production to prop up prices. Companies hold off on supply. Governments stay silent. What went up on fear does not come down on relief. The profit stays locked in.

5. The Public Takes the Hit. Every Time.

Consumers pay instantly. Petrol, food, freight—all rise. Meanwhile, oil majors enjoy a cashflow surge for doing ……nothing. There’s no mechanism to restore balance. No obligation to return profit. The system is one-way: spike fast on panic, trickle down slowly if at all.

The oil sector view would seem to be war breaks out, oil profits soar. Peace returns, prices drift down—maybe. But the damage is done. And underneath it all, the oil itself hasn’t moved. The rigs, tankers, and refineries keep running. The system just found another excuse to charge more—for the same barrel.

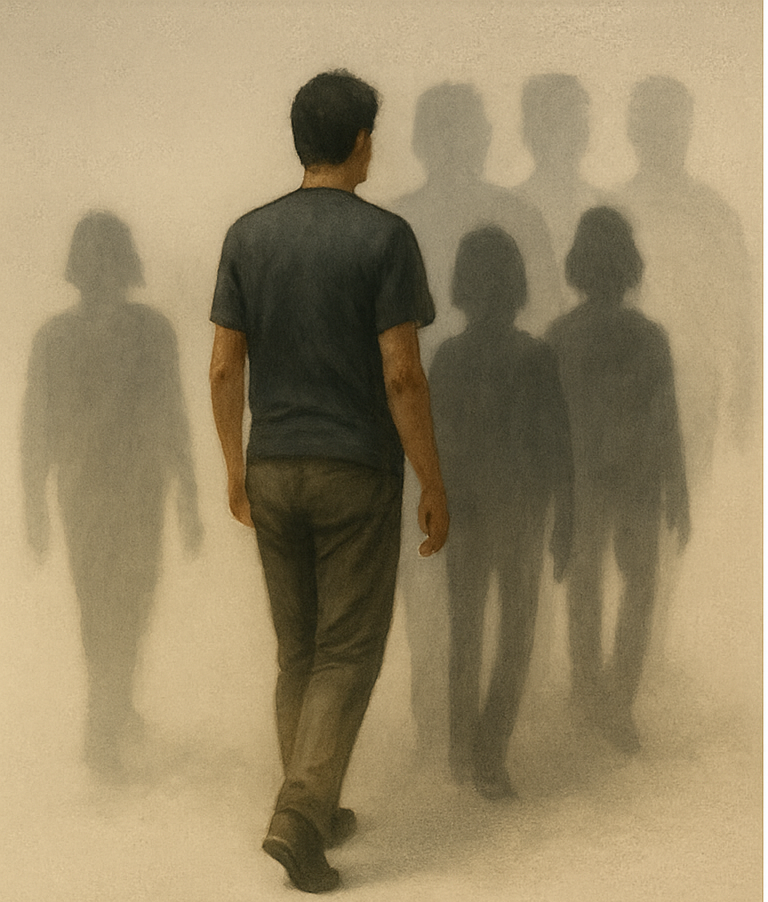

This is not a natural market response. It is a feature of financialised energy—a structural loop in which fear becomes profit and the public carries the cost. These aren’t abstract distortions. They translate into higher prices, slower transitions, and systems designed to monetise risk while offloading consequence. Once again, global companies sit on one side of the equation, facing down national governments and the public with no obligation to share the burden—or the upside.

And if you’re wondering what this has to do with my favorite topic, AI, look closely: the tech giants are the new majors. Different sector, same pattern—power without accountability, profit without balance.